Chapter 2:

Tracking progress

Transparency and accountability are prerequisites for meaningful collaboration among Charter signatories and for the delivery of tangible results.

The Charter calls on signatories to measure and publicly report on their performance and progress in reducing emissions. To this end, all are encouraged to adopt prevailing best practices in their target setting and transition planning.

The OGDC has implemented a phased, multi-year approach for the adoption of a common reporting framework, while working to enhance data quality over time. This ensures that all members can effectively demonstrate their progress and contribution to the Charter’s goals in a unified way.

To gain a clearer understanding of the starting point – and to establish a foundation upon which all signatories can build – in 2024 the OGDC launched the Charter Baselining Survey, a self-reported data collection process amongst signatories.

Signatories were asked a series of questions related to the goals of the Charter. The Secretariat then worked with DNV to independently anonymize, aggregate, and verify consistency with the Charter, performance and progress in reducing emissions and to support continuous improvement in data quality in accordance with internationally recognized frameworks.

DNV also facilitated the exchange of non-public, non-sensitive information with the Charter, notably for state-owned companies, which can face restrictions on data publication. Finally, DNV issued a third-party assurance statement verifying data submission, available in Appendix B of this report.

The 2024 Charter Baselining Survey – and its iterations in the years to come – will be the primary source of data for OGDC as it monitors the progress of signatories toward Charter goals.

“

A survey of the oil and gas industry’s climate performance has never been attempted on this scale. Participants ranged from companies that pioneered operational decarbonization decades ago to those still in the early phases – all with different capabilities and reporting methods.

The lessons learned will be used to improve reporting, visibility and data quality and to create more targeted programs.”

Bjørn Otto Sverdrup

Head of the OGDC Secretariat

Results of the 2024 Charter Baselining Survey

The Charter Baselining Survey aimed to map the climate ambitions of signatories at the point they joined the Charter. The results will be crucial to helping the OGDC understand gaps and identify priorities, as well as to track future progress.

89% of signatories (48 out of 54) were able to provide all or some of the information requested. For many, this was a first.

Overall, the results showed that, before signing up to the Charter and depending on the topic, between 20% and 37% of signatories did not have company-specific emissions reduction ambitions for their operations consistent with the OGDC goals. This confirms that the OGDC marks an important milestone for a significant number of companies.

Among respondents that had ambitions in place, a majority reported they have detailed implementation plans that include such measures as the deployment of low-carbon technology, energy efficiency, changes to operational procedures and specific improvement projects. These companies are well positioned to lead by example, transferring knowledge and best practices, and helping to accelerate the emissions reduction efforts of signatories at earlier stages.

The survey results demonstrate that many companies could benefit from sharing more information about Scope 1 & 2 decarbonization aspirations and climate performance publicly. Still, signatories face different operating realities, with listed and national companies subject to different disclosure requirements and / or country-specific regulations and expectations.

The OGDC is actively working with the six signatories that could not participate – as well as with those that were able to provide only limited information – to help them overcome such challenges as data insufficiency, regulatory restrictions and limitations related to internal processes. The aim is to offer these companies tools and best practices to enable more comprehensive reporting.

“

As a national energy provider and with Azerbaijan hosting COP29 this year, SOCAR has truly benefited from taking part in the Charter Baselining Survey.

If we are to achieve the goal of reaching net-zero emissions by 2050, it is imperative to gain a full understanding of the state of play in the industry, now and in the future, as well as of our performance relative to peers.”

Afgan Isayev

Vice President, State Oil Company of Azerbaijan (SOCAR)

Near-term and long-term scope 1 & 2 ambitions

All signatories were asked whether they had established near- and long-term Scope 1 & 2 ambitions prior to signing the Charter. The results of the DNV analysis are illustrated below.

69% of signatories said they had established ambitions to reach net-zero Scope 1 & 2 emissions by or before 2050 prior to joining the Charter, although 52% highlighted differences in methodologies, target years and greenhouse gases in scope.

Figure 1: Did the signatories have company-specific ambitions consistent with the Charter prior to joining? Were such ambitions made public?

Net-zero operations by or before 2050 ambition (pre-OGDC)

Interim scope 1 & 2 emissions reduction by 2030 ambition (pre-OGDC)

Near-zero methane emissions by 2030 ambition (pre-OGDC)

Zero routine flaring by 2030 ambition (pre-OGDC)

Fully consistent & fully or partially public

Partially consistent & fully or partially public

Partially consistent & not public

Not consistent yet or information not provided on this question

Signatories that did not respond to survey

Assessment by the independent third-party verifier

(Source: DNV analysis of the 2024 Charter Baselining Survey, labels simplified for readability by OGDC and the first two categories merged for simplicity)

CASE STUDY: Decarbonizing ADNOC’s operations

ADNOC aims to achieve net-zero operational emissions by 2045 and to reduce carbon intensity by 25% by 2030. The company focuses on energy efficiency, zero routine flaring, methane emission reductions, electrification using nuclear and solar energy and CCS technologies.

In 2023, ADNOC reduced its Scope 1 & 2 emissions by 6.2 million tons of CO2e (MtCO2e), with 4.8 million tons from clean grid energy. Its upstream greenhouse gas (GHG) intensity was ~7 kilograms of CO2e per barrel of oil equivalent (kg CO2e / boe) — among the lowest in the industry. The company established a zero routine flaring policy in the 2000s and aims to eliminate routine flaring by 2030. The World Bank Global Gas Flaring Tracker Report lists the United Arab Emirates as having one of the lowest flare volumes and intensities among oil and gas producers.

ADNOC’s energy management system includes technology and Artificial Intelligence (AI) deployment, operational improvements, waste heat recovery, renewable energy use and efficient equipment. The Panorama Digital Command Center has saved 15% in energy expenditure since 2017. In 2023, ADNOC achieved 900 kilotons CO2e reductions from energy efficiency initiatives and aims for a 5% improvement by 2025.

ADNOC is decarbonizing offshore operations with a $3.8 billion sub-sea transmission network with TAQA, expected to reduce its offshore carbon footprint by up to 50% by 2026. On-site solar panels at service stations generated over 20,667 MWh of solar energy in 2023.

ADNOC is also leveraging technology and AI to build a future energy system, generating $500 million in value and abating up to 1 million tonnes of CO2 emissions between 2022 and 2023.

In addition, signatories were asked if they had implementation plans in place to support their Scope 1 & 2 ambitions. The results in Figure 2 collate responses only from companies that reported their decarbonization ambitions:

Figure 2: Did the signatories have company-specific implementation plans to underpin their ambitions?

Scope 1 & 2 ambitions and implementation plans (pre-OGDC)

Net zero operations by

or before 2050 ambition

Interim Scope

1 and 2 ambition

Zero Routine

Flaring by 2030

Near Zero

Methane by 2030

Ambitions accompanied by implementation plans

Ambitions but no company-wide implementation plans shared

Assessment by the independent third-party verifier

(Source: DNV analysis of the 2024 Charter Baselining Survey, labels simplified for readability by OGDC and the first two categories merged for simplicity)

Some 70% of OGDC signatories had established an interim ambition for Scope 1 & 2 emissions. Of these, nearly 80% had company-wide

implementation plans that outline how they aim to achieve their respective ambitions.

Approximately two-thirds of signatories had ambitions to eliminate routine flaring by 2030, but only 61% had company-wide implementation plans. In total, half of OGDC signatories (27 companies) are part of the World Bank Zero Routine Flaring Initiative.

While at least 37% of signatories did not have near-zero methane emissions ambitions prior to joining the OGDC, 71% of respondents with methane ambitions in place said they also have company-wide implementation plans. In total, more than 40% of OGDC signatories (24 companies) are part of the UNEP Oil and Gas Methane Partnership 2.0, and all signatories evaluated in the 2023 International Methane Emissions Observatory (IMEO) report have achieved the initiative’s gold standard.

This confirms that decarbonization of operations and target setting, flaring and methane reduction remain priority topics for the OGDC. Signatories are encouraged to set clear interim ambitions and to communicate their implementation plans. The latter will enable more accurate ongoing measurement of collective progress and help the OGDC to identify how it can best support signatories’ climate actions.

Case study: Shell’s methane reduction activities are showing results, allowing them to work towards achieving near-zero methane emissions by 2030

Shell has a range of technologies and work practices in place to help find and fix methane emission sources in their operations. Examples include:

Methane abatement: Shell is using advanced technologies, such as drones and satellite monitoring, to enhance monitoring of methane emissions. At its QGC Upstream gas business in Australia, improved reporting and subsequent measures taken, has reduced reported methane emissions by around 70% since 2017.

Finding methane leaks and improving reporting through direct measurements: By the end of 2023, more than 80% of fugitive emission sources at Shell-operated oil, gas and liquefied natural gas production facilities used leak detection and repair (LDAR) programs to tackle leaks and monitor equipment.

Transparency and accuracy of methane emissions reporting: Shell was awarded Oil and Gas Methane Partnership 2.0 Gold Standard in 2023 for the third consecutive reporting year – meaning 95% of Shell-operated ventures methane emissions are on a credible path to report at levels 4 and 5 by end 2023 and reasonable endeavors are demonstrated to achieve the same in non-operated ventures by end 20254.

4 Levels 4 and 5 of the Oil and Gas Methane Partnership 2.0 (OGMP 2.0) are related to source-level and site-level emissions reporting respectively.

Case study: ExxonMobil Hunts Down Emissions in Real Time with COMET

In 2021, ExxonMobil became the first company to announce plans to reach net-zero Scope 1 & 2 greenhouse gas emissions from unconventional operated assets in the U.S. Permian Basin by 2030. Reducing methane emissions is a key part of that plan. Launched in 2022 with an investment of $20 million, the company’s Center for Operations and Methane Emissions Tracking (COMET) is an initiative designed to centralize, continuously monitor and analyze methane emissions data from sources across ExxonMobil operations in the Permian Basin for rapid detection and mitigation. When fully deployed at all 700 operated sites across 1.8 million acres in the Permian, COMET will ultimately provide near continuous, real-time monitoring in the region.

Case Study: KazMunaIGas Takes Tough Steps to Curb Methane Emissions

KazMunayGas (KMG), the first national company from Kazakhstan to join the United Nations Environmental Program’s Oil & Gas Methane Partnership 2.0, is making real progress in methane management.

To this end, it has collaborated with organizations such as Carbon Limits, Tetra Tech and International Financial Corporation. These organizations have helped KMG assess and reduce methane emissions and to conduct field studies to monitor methane leaks at its subsidiaries. Through these efforts and more, KMG is on track to reach its ambitious methane reduction targets, while enhancing emissions reporting.

Figure 3: Did the signatories have company-specific ambitions consistent with the Charter prior to joining? Were such ambitions made public?

Investment in the energy systems of the future (PRE-OGDC)

Fully consistent & fully or partially public

Partially consistent & fully or partially public

Partially consistent & not public

Not consistent yet or information not provided on this question

Signatories that did not respond to survey

Assessment by the independent third-party verifier

(Source: DNV analysis of the 2024 Charter Baselining Survey, labels simplified for readability by OGDC and the first two categories merged for simplicity)

85% of signatories said they are investing in energy systems outside oil and gas. Investment areas included renewable energy and energy storage, low-carbon fuels and hydrogen, carbon capture, utilization, and storage (CCUS) and carbon-negative emissions innovations such as direct air capture.

Additionally, at least 63% of companies plan to increase such investments in the future. Information on past investments and plans for the future is limited due to it being competitively sensitive for many signatories5.

5 To comply with anti-trust regulations and not share competitively sensitive information, the OGDC adheres to strict data protection criteria and anti-trust regulations.

“

We are proud to be part of the Oil & Gas Decarbonization Charter, a pivotal initiative supporting the transformation that the energy sector must undergo to reduce our collective carbon footprint. As a global, progressive energy company, ADNOC is at the forefront of this transformation. We have an ambition in place to achieve net-zero operational emissions by 2045.

We demonstrate this commitment through proactive measures in emissions reduction, energy efficiency, and pioneering projects like CCS. These initiatives highlight our dedication to delivering tangible progress and making real impact. As we advance our decarbonization efforts, we remain steadfast in driving positive change within the industry and contributing to global climate goals.”

Ibrahim Al Zu’bi

Group Chief Sustainability & ESG Officer, ADNOC

Figure 4: Are the signatories reporting on greenhouse gas emissions?

Reporting on scope 1 & 2 greenhouse gas emissions (pre-OGDC)

Independent third-party verification of scope 1 & 2 emissions (pre-OGDC)

Fully consistent & fully or partially public

Partially consistent & fully or partially public

Partially consistent & not public

Not consistent yet or information not provided on this question

Signatories that did not respond to survey

Respondents for which the question was not applicable

Assessment by the independent third-party verifier

(Source: DNV analysis of the 2024 Charter Baselining Survey, labels simplified for readability by OGDC and the first two categories merged for simplicity)

At the time of the survey, 78% of signatories partially reported GHG emissions. However, only 30% were fully consistent with the Charter and substantiated their analysis with public information. 48% would benefit from more complete reporting and / or more data disclosures, while 11% were not yet reporting GHG emissions in 2023, or didn’t provide enough information for the third party to assess quality of their reporting. About 70% of signatories that do disclose their GHG emissions had adopted independent verification processes.

This initial baseline survey did not provide sufficient or sufficiently uniform data to allow for an aggregation of GHG emissions at the OGDC level – and this is therefore not included in this report. DNV supported this conclusion.

However, the results of this first exercise will be invaluable for establishing the foundations that will allow the OGDC to work toward anonymization and aggregation of numbers in the coming years.

Independent analysis from external source

To supplement the Charter Baselining Survey and overcome the methodological differences in GHG reporting cited earlier, OGDC sought an independent analysis from the research and business intelligence company Rystad Energy. Rystad provided estimates of signatories’ production levels, upstream GHG emissions and geographical presence, based on its own proprietary dataset and methodology.

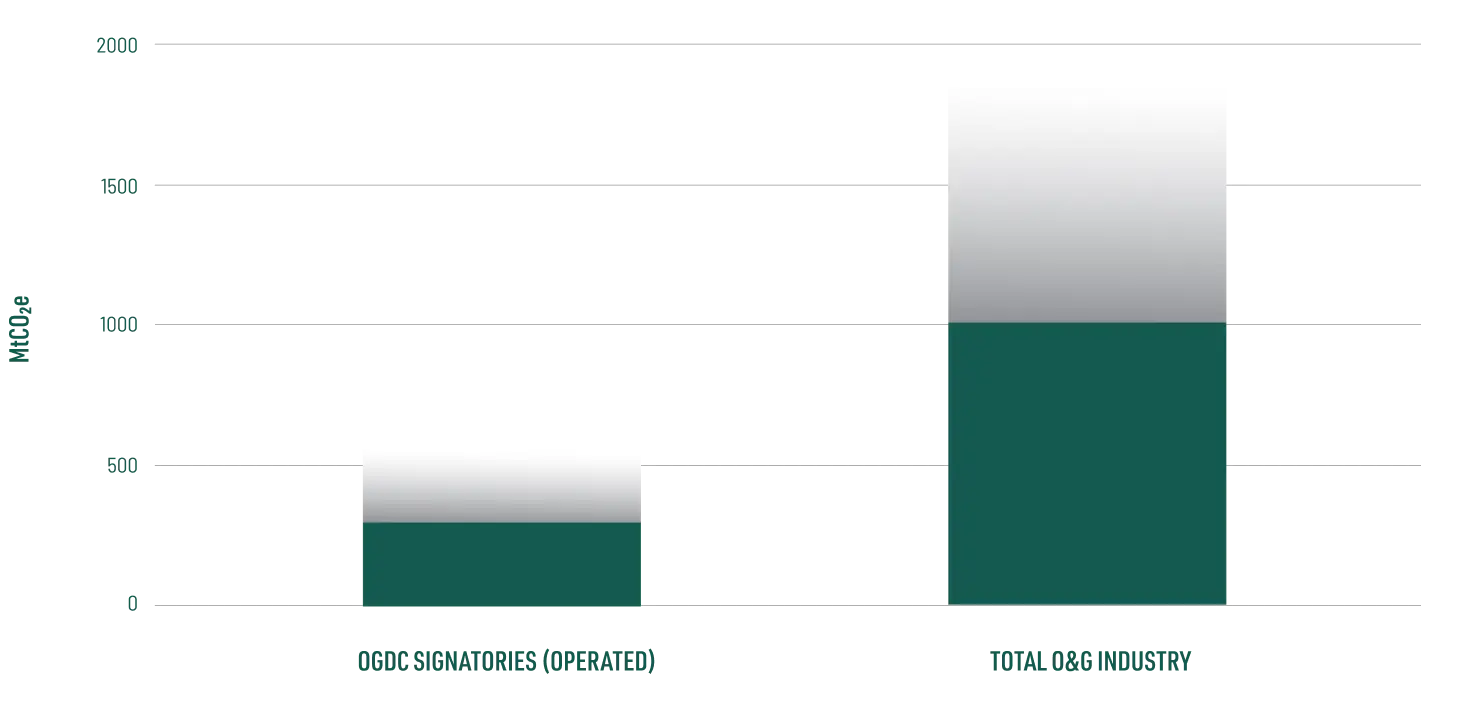

Rystad Energy estimated that absolute GHG Scope 1 & 2 emissions from upstream oil and gas were around 1,900 million tons CO2 equivalent (Mt CO2e) in 2023. They estimated that the OGDC signatories represented around 500 Mt CO2e of that number, of which methane emissions contributed roughly 45%.

Figure 5: Estimated Scope 1 & 2 emissions from OGDC signatories and the global oil and gas industry overall (in 2023)

UPSTREAM SCOPE 1 & 2 GHG EMISSIONS: ABSOLUTE (PRE-OGDC)

C02

CH4 (expressed in CO2e)*

*The methane emissions were converted to CO2 equivalent using a 100-year time horizon global warming potential (GWP) of 25 for fossil-based methane as per IPCC AR4.

(Source: Rystad Energy analysis)

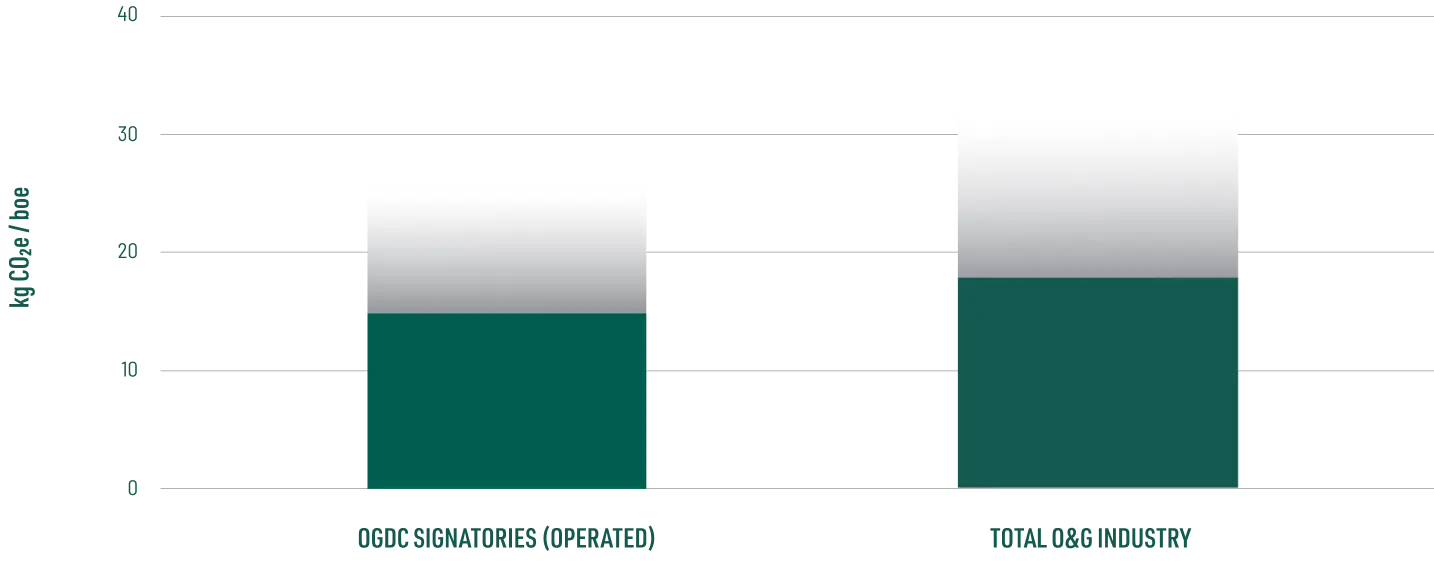

Figure 6: Estimated carbon intensity Scope 1 and 2 of OGDC signatories and global oil and gas industry (in 2023) (Source: Rystad Energy analysis)6

Rystad Energy estimated that the average upstream carbon intensity of Scope 1 & 2 emissions of the entire oil and gas sector was around 32 kilograms CO2 equivalent per barrel of oil equivalent (kg CO2e / boe) in 2023. It further estimated that OGDC signatories had a collective average operated upstream carbon intensity of Scope 1 & 2 emissions of 26 kg CO2e / boe in 2023, including both CO2 and CH4 emissions.

UPSTREAM SCOPE 1 & 2 GHG EMISSIONS: Intensity (PRE-OGDC)

C02

CH4

*The methane emissions are converted to CO2e using a 100-year time horizon Global Warming Potential (GWP) of 25 as per IPCC AR4.

(Source: Rystad Energy analysis)

Estimates from Rystad Energy suggest that assets operated by OGDC signatories are already performing 30% better on average on a carbon intensity basis when compared to the rest of the oil and gas industry. In comparison, the 12 OGCI member companies reported an average of 17.9kg CO2e/boe in 2022 (or in the 2023 Progress Report).

It should be noted that:

- Rystad Energy leverages its proprietary methodology to provide the above estimates, including signatories’ voluntary reporting, regulatory reports, measurements data and internal analysis and interpolation. As such, there is some unavoidable uncertainty around upstream GHG emissions – particularly regarding methane. As a result, its numbers should be considered as ballpark figures only.

- Rystad Energy’s estimates are based on a different methodology and dataset to those used by many companies.

- Neither the OGDC nor its signatories are in a position to validate or confirm Rystad’s data or estimates.

6 Rystad Energy’s upstream methane emissions database is a proprietary field-by-field emissions inventory database combining asset-level reported data (in regions where available), quality aggregated reported data (e.g. company and regional level), methane satellite data, and satellite flaring data (based on VIIRS Nightfire, Colorado School of Mines). Due to the sparse and low data quality in the public domain, bottom-up methane estimates, by definition, do not represent total emissions inventories from the industry.

Case Study: ARAMCO’S ENERGY EFFICIENCY SOLUTIONS

Over the years, Saudi Aramco has successfully reduced its upstream and methane carbon intensities to be among the lowest in the world. Aramco has implemented multiple measures to attain an upstream carbon intensity of 9.6 kg CO2e / boe in 2023, including best-in-class reservoir management practices, flare minimization, GHG emissions management and the methane LDAR.

These measures are complemented by Aramco’s investments in infrastructure, along with its continuous development and deployment of digital solutions to monitor, manage, and reduce its energy intensity and flaring emissions that sets the company apart from most producers.

Among the company’s infrastructure projects is its investment in cogeneration facilities which has contributed to significant improvements in energy efficiency.

Aramco installed 17 cogeneration facilities for high-efficiency energy generation. The Cogen project achieved a total high-efficiency power output of 5.3 Gigawatt (GW) and exported surplus power to the national grid. This resulted in an annual reduction of 7 million tons of CO2 and as a result, lowered energy intensity by 23% between 2011 and 2022.

“

At Aramco, our ambitions and performance extend beyond being a leading supplier of reliable and affordable energy. We are actively pursuing multiple approaches to reducing GHG emissions from our operations through energy efficiency, methane detection and repair and flare minimization. These efforts have enabled us to achieve upstream carbon and methane intensities that are among the lowest in the industry. We are focusing on the development of new energy solutions, including CCS, lower-carbon fuels and hydrogen.

Through Aramco Ventures, we are investing in potential breakthrough technologies and start-ups to find solutions to complex climate challenges. Additionally, we are utilizing robust measurement, reporting and verification processes that use leading international standards to report our Scope 1 & 2 GHG emissions and intensities in a transparent and consistent manner.

As one of the first-term champions of the OGDC, our goal is to leverage our knowledge and expertise to amplify the impact of the industry. Establishing a solid baseline is a key priority for the OGDC this year and a crucial step in driving our journey forward.”

Musaab Al-Mulla

Aramco Vice President of Energy & Economic Insights at Aramco